Toyota auto insurance is key for Toyota owners. It gives financial safety and peace of mind while driving. Knowing about Toyota car insurance helps you choose the best for you.

There are many coverage choices. The right policy protects your Toyota well. This guide will show why good insurance is important for your Toyota.

Toyota Auto Insurance

To understand Toyota auto insurance, we need to look at its main parts. A Toyota insurance policy has many coverages. These cover different risks when you own and drive a car.

To understand Toyota auto insurance, we need to examine its main components. A Toyota insurance policy typically includes various coverages designed to protect you from the diverse risks involved in owning and driving a vehicle. These coverages may range from liability coverage, which protects you if you’re at fault in an accident, to comprehensive and collision coverage, which safeguard your investment against theft or damage. The diversity of available coverages allows drivers to customize their policies based on their unique needs and circumstances, ultimately leading to a better fit for both their budget and lifestyle.

When it comes to protecting your Toyota, understanding your auto insurance options is essential. Toyota auto insurance is designed not only to cover the basic liability and collision requirements but also to offer a range of additional coverages that can be tailored to meet individual driver needs. With the diversity of available coverages, drivers can customize their policies based on their unique needs and circumstances, ultimately leading to a better fit for both their budget and lifestyle. Whether you’re a new driver or have years of experience, it’s crucial to take your time to evaluate your options and select a policy that offers the best protection for your vehicle.

For those looking to save money without compromising on coverage, finding affordable or even cheap Toyota auto insurance is a key consideration. Many providers offer competitive pricing, and factors like driving history, vehicle model, and coverage limits can significantly influence premiums. It’s wise to compare various insurers and their offerings, as this enables you to understand the market and discover policies that may offer better rates while still providing the essential protective features you need. Remember that the cheapest option may not always provide the best value in the long run, so ensure that the coverage aligns with your requirements.

Doing a thorough Toyota auto insurance comparison will help you identify the best-fit policy for your specific situation. As you review multiple quotes, look for discounts that may apply, such as those for safe driving records or bundling with other types of insurance. Additionally, consider the reputation of the insurance provider, including their customer service ratings and claims process experiences. Investing time in a comprehensive comparison can lead to significant savings and ultimately ensures you have the right Toyota auto insurance protection without stretching your budget.

In the end, the goal when selecting Toyota auto insurance is to secure the coverage you need for peace of mind while driving. By understanding the various options available and taking the time to evaluate them based on your personal circumstances, you can find a policy that strikes a balance between affordability and comprehensive coverage. Always remember that your Toyota deserves reliable protection, and with the right insurance policy, you can drive confidently knowing that you’re well covered on the road.

One key aspect of obtaining the best Toyota auto insurance is understanding the factors that influence premiums. Toyota auto insurance has made strides in equipping its vehicles with advanced safety features, which can significantly reduce the likelihood of accidents and, consequently, insurance costs. Many models come with features such as adaptive cruise control, lane departure warnings, and automated emergency braking, which not only promote safer driving habits but also can lower premiums due to the decreased risk perceived by insurance providers. This ultimately raises the question of how does Toyota reduce cost? By focusing on safety and reliability, they create vehicles that not only appeal to consumers but also come with lower insurance rates.

When considering the broader insurance landscape, it’s also relevant to think about other brands, such as Honda. Prospective buyers might ask, what is the cheapest Honda to insure? Generally, insurance costs are influenced by various factors including the vehicle’s safety rating, repair costs, and likelihood of theft. Models with a strong reputation for safety often lead to lower premiums. Comparing different models from both Toyota and Honda can help potential buyers gauge the overall affordability of their preferred choice in terms of insurance.

In conclusion, understanding the intricacies of Toyota auto insurance and exploring the potential savings available through safety features can empower consumers to make informed decisions. By evaluating their insurance options thoroughly and considering the benefits of different models, drivers can ensure they select the best coverage for their Toyota while also capitalizing on any cost-saving opportunities. With a bit of research, securing the right auto insurance doesn’t have to be a daunting process.

Here are the main parts of a Toyota auto insurance policy:

- Liability Coverage: This helps if you cause an accident. It covers damage to another car and medical bills.

- Collision Coverage: This pays for fixing or replacing your car if it’s damaged in an accident.

- Comprehensive Coverage: This part covers damage not from accidents, like theft, vandalism, or natural disasters.

- Personal Injury Protection: This covers medical costs for you and your passengers if you’re hurt in an accident.

Knowing these parts helps you understand your insurance better. Each part is important for good protection. It makes sure your insurance fits your driving and financial needs.

The Importance of Having Insurance for Your Toyota

Having a Toyota means you have to take care of it. Getting the right insurance is key. It helps protect you from accidents, theft, or damage.

Owning a Toyota is a commitment to not only enjoying a reliable vehicle but also ensuring its longevity and safety on the road. One of the most effective ways to safeguard your investment is by securing the right car insurance for your Toyota. This is more than just a legal requirement; it provides peace of mind knowing that you are covered in case of unexpected events such as accidents, theft, or natural disasters. With a comprehensive insurance policy, you can drive your Toyota with confidence, knowing you’re prepared for any mishaps that may come your way.

When seeking a Toyota auto insurance provider, consider the specific coverage options that fit your needs. It’s crucial to compare different policies to find one that offers a balance between affordability and adequate protection. A Toyota motor insurance policy should cover not only basic liability but also offer collision and comprehensive coverage, ensuring that you’re fully protected against a wide range of risks. Remember to look for providers that specialize in Toyota vehicles, as they may have tailored packages that understand the needs and value of your specific model.

Additionally, possessing the right insurance can significantly ease the financial burden that follows an accident or theft. Without a solid insurance policy, you could face hefty repair or replacement costs that can strain your budget. By investing in car insurance for your Toyota, you are essentially creating a safety net, allowing you to focus on enjoying your vehicle rather than worrying about potential financial pitfalls. This proactive approach is vital, especially in today’s unpredictable world where accidents can happen at any moment.

In conclusion, driving a Toyota auto insurance is not only about the enjoyment of the ride but also about being responsible in managing your asset. Having appropriate insurance in place is a key step in ensuring that you can enjoy your vehicle without excessive worry. Take the time to research and select the best Toyota auto insurance providers to find a policy that protects and aligns with your lifestyle, ensuring that every journey remains a pleasant experience.

Insurance is very important. It’s the law in most places. Without it, you could face big fines and legal trouble. It also helps pay for repairs and medical bills after an accident.

Having insurance for your Toyota is not just a legal necessity; it is a smart financial decision that can save you from significant out-of-pocket expenses in the event of an accident or damage. Toyota owners often invest a considerable amount into their vehicles, making it essential to protect that investment with proper coverage. The best auto insurance for Toyota auto insurance will not only cover repairs but also ensure that you’re protected from any liability claims that might arise if you are at fault in an accident.

One of the key advantages of having Toyota vehicle insurance coverage is peace of mind. Whether you’re driving through the city, embarking on a road trip, or just commuting to work, knowing that you are covered can alleviate stress. With various coverage options available, you can tailor your policy to suit your lifestyle and driving habits. Comprehensive insurance can cover events such as theft, vandalism, or natural disasters, which are critical types of protection for any vehicle owner.

Furthermore, investing in Toyota vehicle insurance is vital not only for your security but also for that of other road users. Driving without adequate insurance puts you at risk of hefty fines and legal implications, particularly if you cause an accident. Insurance ensures that you can cover medical bills and property damage incurred by others, safeguarding you from financial ruin. Choosing the right policy ensures that you are compliant with laws while also protecting your own interests.

Ultimately, navigating the different types of coverage and finding the best auto insurance for your Toyota can feel overwhelming, but it is worth your time and effort. By doing your research and shopping around, you can secure a policy that offers comprehensive protection and is tailored to your needs as a Toyota owner. This investment in insurance is an essential step towards responsible vehicle ownership, ensuring that you’re prepared for whatever comes your way on the road.

Having insurance gives you peace of mind. It lets you drive without worrying. It’s a smart choice that keeps you safe and confident.

Types of Toyota Insurance Coverage

It’s key for Toyota owners to know about different insurance types. Each policy guards against different risks of owning a car. Here are the three main types, each playing a big role in protecting your car.

For Toyota owners, understanding the various types of insurance coverage is essential to ensure maximum protection for their vehicles. Each insurance policy is designed to guard against specific risks associated with car ownership. The three main types of coverage are liability, collision, and comprehensive insurance. Liability coverage helps pay for damages or injuries you may cause to others in an accident, ensuring you are financially protected against third-party claims. Collision insurance covers the cost of repairs to your own vehicle after an accident, regardless of who is at fault, while comprehensive insurance protects against non-collision-related incidents such as theft, vandalism, or natural disasters.

Classic Car Insurance Florida: 2 Ultimate Protection

When considering the best Toyota insurance coverage, it’s important to evaluate your individual needs and the potential risks that come with driving your vehicle. Toyota auto insurance quotes can vary significantly based on factors like your driving history, the model of your car, and your location. By obtaining multiple quotes from different providers, you can compare coverage options and premium costs to find a policy that suits your budget and offers adequate protection. Remember, the cheapest option isn’t always the best; it’s crucial to strike a balance between affordability and comprehensive coverage.

Many Toyota owners ask, “Why choose Toyota auto insurance?” One compelling reason is the specialized expertise that comes with insuring a vehicle recognized globally for its reliability and safety. Toyota’s insurance options often come with tailored benefits, like rental reimbursement, roadside assistance, and coverage for factory-installed parts, giving drivers peace of mind. Additionally, with automated features that focus on risk assessment, many providers offer discounts for safe driving and bundling policies, which can further enhance the value of your insurance.

In conclusion, selecting the right type of insurance coverage is vital for Toyota owners to protect their investment while enjoying the driving experience. By understanding the different types of insurance available and considering the unique benefits of Toyota auto insurance, you can make an informed decision that best fits your needs and lifestyle. It’s not just about compliance; it’s about ensuring you’re prepared for the unexpected on the road.

Liability Coverage

Liability coverage helps if you hurt someone or damage their property in an accident. It’s often needed and has two parts: for injuries and for property damage. Having enough liability coverage can lessen financial stress after an accident.

Collision Coverage

Collision coverage helps fix your Toyota if it hits something or someone, no matter who’s at fault. It pays for repairs or a new car if needed. It’s a good choice for those who want to feel safe on the road.

Comprehensive Coverage

Comprehensive coverage guards against things like theft, vandalism, and natural disasters. It keeps your Toyota safe from unexpected problems. This coverage is key for keeping your car’s value up.

| Type of Coverage | Description | Importance |

|---|---|---|

| Liability Coverage | Protection against injury or damage claims from another party. | Helps prevent financial loss in legal situations. |

| Collision Coverage | Covers damage to your Toyota resulting from a collision. | Ensures quick repairs and minimizes out-of-pocket expenses. |

| Comprehensive Coverage | Protection against theft, vandalism, and other non-collision incidents. | Safeguards your investment against unpredictable events. |

What Does a Toyota Insurance Policy Cover?

Toyota insurance coverage can change based on who you choose and what you pick. Most Toyota insurance policies have key protections. They help cover the car and people inside it well.

When exploring what a Toyota insurance policy covers, it’s crucial to understand that coverage varies depending on the insurance provider you select and the specific options you choose. Generally, the best Toyota insurance providers offer extensive coverage that includes liability protection, comprehensive and collision coverage, and personal injury protection. Liability coverage typically safeguards you if you cause an accident, while comprehensive coverage protects against non-collision incidents like theft or natural disasters. Collision coverage, on the other hand, pays for damage to your vehicle following an accident, ensuring that you have comprehensive protection for your Toyota.

In addition to standard coverage, many policies can be tailored to meet specific needs, such as roadside assistance and rental car reimbursement. This flexibility is particularly valuable for Toyota owners who want to enhance their peace of mind while on the road. To make a well-informed decision, it’s advisable to engage in a Toyota insurance comparison among various providers. This can reveal which offers the most comprehensive protection at competitive rates, ensuring that your Toyota remains safeguarded against various eventualities.

Furthermore, obtaining Toyota vehicle insurance quotes is a straightforward process that can provide insights into your options and potential savings. Many insurance companies have online tools that allow you to customize quotes based on your vehicle model, driving history, and coverage preferences. By leveraging these tools, you can easily identify which policies align best with your needs and budget. Remember, while the yearly premium is an essential factor, the level of coverage and the provider’s reputation for customer service should also be pivotal elements in your decision-making process.

Ultimately, a well-rounded Toyota insurance policy not only protects your vehicle but also provides financial security for you and your passengers. As you navigate the various options available, remember to consider factors like coverage limits, deductibles, and additional perks offered by different insurance providers. This thorough approach will help you find the most suitable insurance plan that reflects your needs and ensures a worry-free driving experience in your beloved Toyota.

https://youtube.com/watch?v=0Kaj8HXbM0k

- Bodily Injury Liability: Pays for medical bills and damages if you’re at fault in an accident.

- Property Damage Liability: Covers damage to other people’s property in an accident.

- Collision Coverage: Helps pay for fixing or replacing your car after an accident, no matter who’s at fault.

- Comprehensive Coverage: Protects against theft, vandalism, or natural disasters that aren’t car accidents.

- Uninsured/Underinsured Motorist Coverage: Helps if you’re hit by someone who doesn’t have enough insurance.

You can also add extra things to your policy. These might include roadside help, a car to rent while yours is fixed, or insurance for things in your car. Knowing what your policy covers is key to picking the right Toyota insurance for you.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Protection against medical expenses for injuries to others caused by the insured driver. |

| Property Damage Liability | Covers the cost of damage done to another person’s property in an accident. |

| Collision Coverage | Funds repairs or replacement of the insured vehicle after a collision. |

| Comprehensive Coverage | Protection against theft, vandalism, and natural disasters. |

| Uninsured/Underinsured | Covers costs associated with accidents involving drivers with insufficient insurance. |

How to Get Toyota Insurance Quotes

Getting toyota insurance quotes is key to finding great rates for your car. It’s easy if you follow these steps:

- Start with online tools like QuoteWizard and ValuePenguin. They help you get quotes from many insurers.

- Have your Toyota’s details ready. This includes make, model, year, and driving history. It helps get accurate car insurance quotes.

- Use comparison websites. They let you see many quotes at once. This makes it easier to find the best one for you.

- Talk to local agents. They might offer discounts or share info not found online.

- Check your current policy. Changing it might save you money or add benefits.

After getting quotes, look at them carefully. Notice the coverage limits, deductibles, and any extra features. These can affect your choice.

Toyota Insurance Rates: What You Need to Know

Getting to know Toyota insurance rates can be tricky. Many things affect how much you’ll pay. These include how risky you are and who you are.

Getting to know Toyota insurance rates can be tricky. Many factors influence how much you’ll pay, including your driving history, location, age, and the specific model of your Toyota. Insurance companies assess these elements to determine your risk level, which ultimately impacts your premium. Generally, safer cars like Toyotas tend to attract lower insurance rates due to their reputation for reliability and performance in crash tests. This means that if you own a model that has a high safety rating, you might enjoy lower premiums focused on Toyota car safety insurance.

read: Principal Dental Insurance: 5 Top Protect Coverage Plans

When searching for coverage, it’s vital to understand the different types of insurance available to Toyota owners. Comprehensive and collision coverage are generally recommended, but your choice of deductibles can also affect your overall rates. If you select higher deductibles, your out-of-pocket expenses in the event of a claim increase, but your monthly premiums may be lower. Conversely, lower deductibles will offer more immediate financial relief in the event of a claim but can result in higher monthly insurance costs.

While Toyota insurance rates may vary widely, you can find the cheapest auto insurance for Toyota by comparing quotes from multiple providers. Taking the time to shop around allows you to see any discounts you might qualify for—such as multi-policy discounts if you combine your auto and home insurance. Additionally, many insurance companies offer discounts for safety features commonly found in newer Toyota models, further reducing your costs.

Finally, maintaining a clean driving record is crucial in securing lower insurance rates. A history free from accidents, tickets, or other violations demonstrates to insurers that you are a responsible driver, which can lead to significant savings on your premium. Overall, understanding how to navigate Toyota insurance rates can empower you to make informed choices about your coverage and keep your insurance costs manageable.

Key factors affecting Toyota insurance rates include:

- Type of Vehicle: The model and age of your Toyota matter a lot. New or fast cars usually cost more to insure.

- Driver Demographics: Young or new drivers often pay more. This is because they’re seen as riskier.

- Location: Places with lots of cars and traffic cost more to insure. But, quiet areas might be cheaper.

- Coverage Choices: What you choose to cover (like accidents or damage) changes your insurance price.

To sum up, knowing about insurance rates is key for car owners. By looking at these factors, you can pick the best insurance for you. This way, you get good coverage without spending too much.

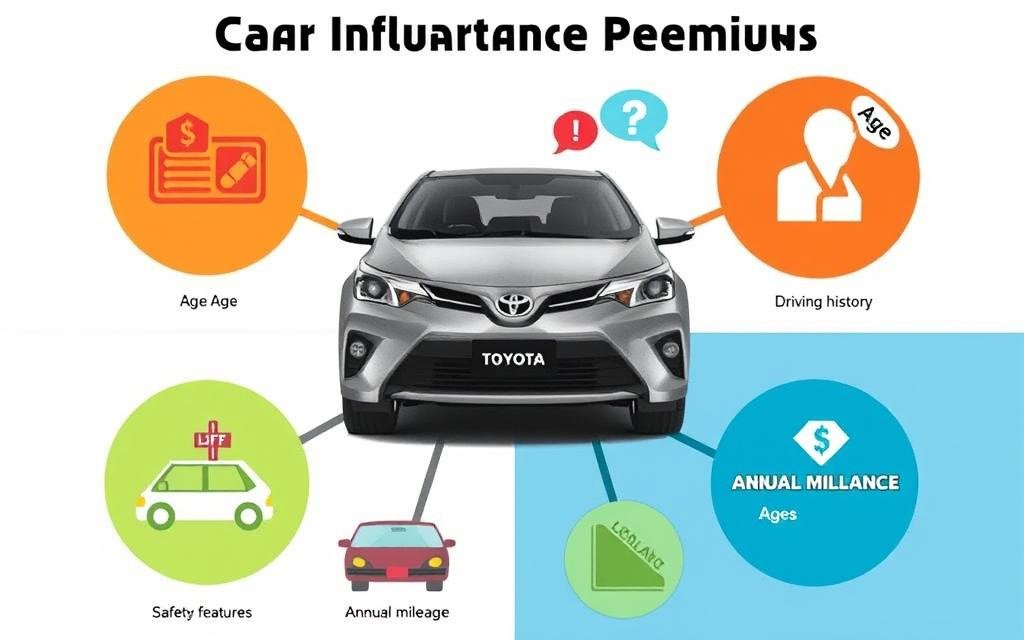

Factors That Affect Your Toyota Insurance Premium

Many premium factors affect your Toyota insurance cost. Knowing these can help you get better rates. Key factors include your vehicle model, age, driving history, and claims history.

Insurers look at your Toyota model closely. Cars with high safety ratings cost less to insure. But, cars that get stolen a lot can make your rates go up.

Your car’s age matters too. New cars are more expensive to insure because they’re worth more. Also, driving safely can lower your rates. A clean driving record shows you’re less risky.

When it comes to determining your Toyota insurance premiums, several factors come into play that can influence the cost of your coverage. One of the primary considerations is the model and age of your vehicle. Newer Toyotas generally attract higher premiums due to their increased value, while older models may qualify for lower rates as they depreciate over time. Additionally, the specific model you drive can impact your insurance costs. High-performance vehicles often carry higher premiums because they are statistically more likely to be involved in accidents, while standard sedans may be more affordable to insure.

Another important factor affecting your Toyota insurance premiums is your driving history. Insurers typically reward drivers with clean records, meaning those without accidents or traffic violations often see reduced rates. This reflects a lower risk of filing claims, allowing insurance companies to offer more favorable pricing. Conversely, a history of accidents or violations can lead to increased premiums, as it indicates a greater likelihood of future incidents.

When it comes to determining the premium for your Toyota insurance, several factors come into play that influence how much you will pay. One of the primary factors is the model and age of your vehicle. Newer models equipped with advanced safety features often qualify for lower insurance rates, because they are less likely to be involved in accidents or theft. Additionally, specific Toyota models may be considered lower risk based on their overall safety ratings and historical claims data. This is why it is essential to compare Toyota insurance rates across different companies to find the most competitive pricing tailored to your vehicle type.

read about: Otto Insurance: 1 Affordable Coverage You Can Trust

Another critical element influencing your insurance premium is your driving history. A clean record with no accidents or traffic violations generally allows insurance companies to offer better car insurance rates, reflecting the lower risk of insuring you. On the other hand, if you have a history of claims, such as speeding tickets or at-fault accidents, you may face higher premiums. Insurance for Toyota cars can vary significantly depending on these personal factors, highlighting the importance of maintaining a good driving record to keep your rates manageable.

Moreover, your geographical location significantly impacts your insurance costs. Living in an area with higher rates of theft or accidents can increase your premiums, while those in quieter neighborhoods tend to enjoy lower insurance costs. Alongside location, your age, credit score, and even your annual mileage can also play into how much you pay for coverage. Insurers frequently assess these details when calculating the best car insurance rates for you, emphasizing the need to be proactive about your driving habits and financial health.

To ensure you’re getting the best deal, it’s wise to shop around and compare premiums among various insurance providers. Different companies have unique algorithms and criteria for setting their rates, meaning that there could be significant discrepancies in what they offer for the same coverage. Taking the time to thoroughly research and compare your options can lead to substantial savings on insurance for Toyota cars, allowing you to find a plan that suits both your budget and your driving needs.

Your location also plays a critical role in determining insurance costs. Urban areas typically exhibit higher premiums due to increased traffic congestion and a higher likelihood of accidents or theft. If you live in a quieter, rural area, you might benefit from lower rates. To secure the best possible deal on your Toyota insurance, it’s advisable to compare rates from different providers. Each insurer evaluates risk factors differently, and shopping around can help you identify the most suitable policy for your needs.

Lastly, taking advantage of available Toyota insurance discounts can significantly reduce your premiums. Many insurers offer incentives for features such as anti-theft devices, safety equipment, or bundling multiple policies. Additionally, loyalty discounts or low-mileage incentives may also apply, further helping you to save. By understanding and leveraging these factors, you can effectively manage your Toyota insurance costs and ensure you find the best possible coverage at an attractive rate.

about read GAINSCO Auto Insurance: 4 Affordable Coverage Options

Claims history is very important. If you file claims often, your rates might go up. But, if you rarely file claims, you could save money. Keeping your car in good shape also helps lower costs.

The table below shows important factors that affect your Toyota insurance premium:

| Premium Factor | Influence on Premium |

|---|---|

| Vehicle Model | Higher safety ratings often lead to lower premiums |

| Vehicle Age | Newer models may incur higher rates |

| Driving History | Clean records can result in discounts |

| Claims History | Frequent claims can increase premiums |

Toyota Auto Insurance Discounts and Savings

Toyota owners can get many toyota auto insurance discounts to lower their premiums. Insurance companies give these discounts for safe driving and smart car choices. Here are some big savings options for drivers:

- Safe Driver Discounts: Insurers give discounts for drivers with no accidents or tickets.

- Multi-Policy Discounts: Saving money by having home and auto insurance together.

- Vehicle Safety Features Discounts: Getting discounts for cars with safety features like anti-lock brakes.

- Good Student Discounts: Students with good grades get discounts for being responsible.

- Low Mileage Discounts: Driving less means less risk and lower rates.

These discounts help make Toyota auto insurance cheaper. Knowing and using these toyota auto insurance discounts can save a lot of money over time.

| Discount Type | Description | Potential Savings |

|---|---|---|

| Safe Driver | For maintaining a clean driving record. | Up to 20% |

| Multi-Policy | Bundle auto with other types of insurance. | Up to 15% |

| Vehicle Safety Features | For having modern safety features in the vehicle. | Up to 10% |

| Good Student | For students with high academic performance. | Up to 25% |

| Low Mileage | For driving less than a set number of miles annually. | Up to 15% |

Comparing Toyota Insurance Options

When you want to compare toyota insurance, think about a few key things. Look at what each policy covers, how much it costs, and how good the service is. This helps you find the best options for toyota.

When looking to compare Toyota insurance options, it’s crucial to consider several factors that can significantly impact your overall experience and satisfaction. Start by examining the coverage offered by different providers; policies can range from basic liability to comprehensive plans that include collision and uninsured motorist coverage. Each Toyota insurance provider has different features and add-ons that may better suit your needs, whether you drive a compact Prius or a rugged Tacoma. Understanding these nuances will help you make an informed decision tailored to your vehicle and personal preferences.

In addition to coverage, the cost of insurance should be a primary consideration. Premiums can vary widely between providers, so it’s wise to gather quotes from multiple companies to find the best rates. Keep in mind that the cheapest option may not always be the best in terms of coverage and customer service. Engaging with platforms like Toyota auto insurance Reddit can offer insights from other Toyota owners who have shared their experiences, helping you weigh the financial implications of your choices against the quality of service you can expect.

Furthermore, don’t overlook the importance of customer service and claims handling. A reliable insurance provider will have a reputation for excellent support and a smooth claims process, especially in times of distress after an accident. Online reviews and community discussions can provide valuable feedback on how quickly and effectively different companies respond to claims. By taking the time to compare Toyota insurance plans based on these key elements, you pave the way for a decision that not only meets your budgetary needs but also ensures peace of mind while on the road.

Ultimately, comparing Toyota insurance options requires a blend of practical considerations and personal preferences. While cost is certainly important, the value of a robust policy backed by responsive service can make a significant difference in your ownership experience. By conducting thorough research and utilizing resources like forums and customer reviews, you can confidently choose a plan that aligns with both your driving habits and your unique lifestyle.

It’s smart to check both the policy details and what others say about the service. Use sites like Trustpilot and Insurer Ratings to see how companies do. Also, check out The Balance for more info on Toyota car insurance.

| Insurance Provider | Coverage Options | Average Monthly Cost | Customer Satisfaction Rating |

|---|---|---|---|

| Geico | Liability, Collision, Comprehensive | $120 | 4.5/5 |

| State Farm | Liability, Collision, Personal Injury Protection | $140 | 4.0/5 |

| Progressive | Liability, Collision, Comprehensive | $130 | 4.3/5 |

Spending time to compare toyota insurance can really pay off. Think about what matters most to you. Do you want cheaper prices or better service? This will make your Toyota ownership better.

When considering your options for insuring your Toyota, it’s essential to take the time to compare Toyota insurance quotes from various providers. Each insurance provider has its own unique offerings, which can significantly affect both your premiums and the coverage you receive. By diving deep into the details, you can find a policy that not only fits your budget but also meets your specific needs for peace of mind while driving your Toyota. For some, the priority may be finding the most affordable rates, while for others, the emphasis may be on superior customer service or specialized coverage options.

Cyber Insurance for Technology Companies: 5 Protect Now

One popular choice among Toyota owners is to buy Toyota insurance online, which allows for a quick and convenient way to gather information and make informed decisions. Many insurance companies have user-friendly platforms that enable you to input your details and get instant quotes tailored to your situation. This method not only saves time but also allows you to compare policies side by side easily. With just a few clicks, you can analyze what different companies are offering, ensuring that you don’t miss out on competitive pricing or favorable terms.

In addition to standard coverage, many Toyota owners consider Toyota comprehensive insurance to protect against a wide array of potential risks. This type of insurance covers damages that aren’t related to collisions, such as theft, vandalism, natural disasters, and more. By integrating comprehensive coverage into your insurance plan, you can enjoy greater assurance knowing that your vehicle is well protected in various circumstances. When you compare quotes, be sure to look at how comprehensive coverage fits into each policy and compare the exclusions and conditions to find the best fit for you.

Ultimately, taking the time to compare Toyota insurance options can lead to substantial savings and tailored coverage, enhancing your overall ownership experience. Whether you prioritize cost savings or comprehensive protection, weighing your choices with care is vital to securing a plan that aligns with your lifestyle and driving habits. Remember to keep your options open and dig into the details—your perfect Toyota insurance policy is out there waiting for you.

Why Choose Toyota Auto Insurance?

Choosing the right insurance is key for car owners, especially those with Toyotas. Toyota auto insurance has many benefits. It offers special coverage for Toyotas, protecting their unique needs and features.

Toyota coverage also means getting help from Toyota experts. They know a lot about these cars. This makes filing claims easier and gives you peace of mind.

Another big plus is that you can get a policy that fits you. Whether you need basic or full coverage, Toyota insurance can adjust to your needs and budget. This makes it a great choice for drivers looking at their options.

- Specialized Coverage: Designed specifically for Toyota vehicles.

- Expert Support: Assistance from Toyota specialists.

- Tailored Policies: Options that fit your individual needs.

Toyota auto insurance has special perks that show why it’s a smart choice. By thinking about Toyota auto insurance, car owners can get the right coverage and support they need.

Best Insurance Providers for Toyota Vehicles

Many top insurers offer great coverage for Toyota cars. They have good rates and service. This makes them great for Toyota owners who want to keep their cars safe.

| Insurance Provider | Strengths | Weaknesses | Standout Policies |

|---|---|---|---|

| Allstate | High customer satisfaction; extensive coverage options | Premiums can be higher compared to competitors | New car replacement coverage |

| GEICO | Competitive rates; strong online tools | Limited availability for specific coverage types | Multi-policy discounts |

| State Farm | Personalized service; wide availability | Website navigation can be challenging | Drive Safe & Save program |

| Progressive | Flexible payment options; strong performance in claims | Complex policies may confuse customers | Snapshot program for additional savings |

These are some of the best insurance providers for Toyota cars. Each has its own good points and things to watch out for. Toyota owners should look at different quotes and policies to find the best one for their car.

Toyota Auto Insurance: Finding Affordable Options

Looking for cheap Toyota insurance? It’s key to find ways to save money without losing protection. Start by comparing prices from different companies. This helps you find the best deals for your needs.

Also, check if you can change your policy to save money. Adjusting your deductible or coverage can cut costs. Think about what you really need to keep your car safe.

read Cyber Insurance Coverage Silverfort: 5 Protect Your Data

When it comes to protecting your vehicle, exploring your Toyota auto insurance policy options can help you find a plan that suits both your needs and budget. Each driver has unique requirements, and understanding the different types of coverage available is essential for making informed decisions. From liability coverage to comprehensive plans, selecting the right policy can provide peace of mind and safeguard your financial future.

Toyota comprehensive insurance plans offer coverage that goes beyond mere liability, protecting you against damages resulting from theft, vandalism, or natural disasters. While these plans may seem more expensive upfront, they can prove invaluable in the long run, especially if an unexpected incident arises. Researching different insurers will help you identify which offers competitive rates for comprehensive coverage, potentially leading to substantial savings on your premiums.

Finding affordable Toyota insurance doesn’t have to be a daunting task. Start by gathering quotes from various providers and comparing their offerings. Many insurers provide discounts for safe driving records, multi-policy arrangements, or even affiliation with certain organizations. Additionally, some plans come with flexible payment options that can help you manage your finances more effectively.

Don’t hesitate to review your current policy regularly. Over time, your insurance needs may change, and you might discover that adjusting your deductible or modifying your coverage can lead to reduced premiums. By understanding what you really need to keep your Toyota safe while also being financially prudent, you can ensure that you’re getting the best deals for your needs without sacrificing quality coverage.

Don’t forget to look for discounts. Many companies give discounts for safe driving, bundling policies, or being a long-time customer. These can make your insurance cheaper.

In short, saving money on insurance takes some work. But by doing your homework and using discounts, you can get good coverage without breaking the bank.

Progressive Pet Insurance Reviews: 3 Honest Feedback

How to File a Claim with Toyota Auto Insurance

Filing a claim with Toyota auto insurance is easy. It’s made to help you fast. Knowing the steps makes it smoother and quicker.

Here are the key steps to file claims with Toyota auto insurance:

- Report the Incident: Tell your insurance about the accident or damage right away. Get the date, time, place, and what happened.

- Document Evidence: Get photos of the damage, witness statements, and police reports. These help your case a lot.

- Contact Your Insurance Agent: Call your Toyota insurance agent or claims team. Give them all the info and follow their steps.

- Fill Out Claim Forms: Fill out all needed forms right. Put in all the details about the incident. Missing info can slow things down.

- Submit Your Claim: Send in your forms and documents to your insurance. Make sure to use their preferred way, like online or by mail.

- Follow Up: Keep an eye on your claim’s status. Talk to your adjuster often and give them more info if needed.

While you wait, your insurance will keep you updated. Being organized and detailed helps your claim go smoothly.

Toyota Auto Insurance Reviews: What Customers Say

Looking into Toyota auto insurance? It’s key to check what others say. Reviews on sites like Yelp, ConsumerAffairs, and Google Reviews show what people think. They talk about how good or bad the insurance is.

Many like the prices and the wide range of coverage. People say good things like:

- Claims get processed fast.

- The customer service is quick to help.

- There are many options to choose from.

But, some have complaints too. They talk about:

- Some discounts are hard to get.

- Waiting a long time for claims to be reviewed.

- Not always clear about what’s covered.

Reviews show that opinions on Toyota auto insurance vary. Knowing the good and the bad helps others decide. It’s important to read the details carefully when picking a policy.

When it comes to Toyota auto insurance, customer reviews reveal a wide spectrum of experiences that can significantly influence car owners’ decisions. Many users appreciate the tailored coverage provided by Toyota’s specific insurance plans, highlighting how they cater to the unique needs of Toyota vehicles. Customers have praised the peace of mind offered by these plans, especially concerning liability coverage and protection against theft or accidents. However, others have voiced concerns about the premium rates, suggesting that while the coverage is robust, it may come at a higher cost compared to some other car insurance providers.

In examining Toyota vehicle insurance plans, it’s clear that understanding the nuances is essential. Several reviews emphasize the importance of comprehending the policy specifics, as coverage can vary widely among different providers. Many customers recommend delving deep into the policy documents to grasp all aspects of what’s covered, from comprehensive coverage to roadside assistance. This diligence can help potential buyers avoid any unpleasant surprises when filing claims or seeking repairs.

While Toyota car insurance providers offer various benefits, including discounts for safe driving and multi-car policies, some customers have reported mixed experiences regarding customer service. Some users laud the efficiency and quick response times of claims processing, while others mention frustration with lengthy waiting periods or difficulties in reaching support representatives. These contrasting narratives highlight the importance of researching not just the coverage but also the service quality before selecting an insurance provider.

Overall, the Toyota auto insurance review landscape illustrates that prospective customers must weigh both the positive and negative feedback. By collecting firsthand insights, individuals can make informed decisions based on their own priorities, whether that’s comprehensive coverage, affordability, or reliable customer support. As with any insurance choice, a thorough comparison process goes a long way in ensuring satisfaction in the long run.

Conclusion

Choosing the right insurance for your car is key to keeping your money safe. We talked about different kinds of coverage and why a good policy is important. We also looked at how to get the best prices.

Toyota auto insurance helps protect you from surprises. It offers coverage that fits your needs. Think about what each policy can do for you.

Good insurance meets the law and makes owning a car better. Look at different policies and providers. This way, you can find the best coverage for your Toyota and save money.

FAQ

Does Toyota have its own insurance?

No, Toyota does not have its own insurance. But, they work with many insurance companies. This is through Toyota Insurance Services.

What is the most expensive Toyota to insure?

The Toyota Land Cruiser and Toyota Supra are usually the priciest. This is because they are very valuable and fast.

What is basic car insurance in Dubai?

Basic car insurance in Dubai covers damages to others. It also covers injuries in accidents. But, it doesn’t cover your own car.

What is the cheapest Toyota to insure?

The Toyota Corolla and Toyota Camry are often the cheapest. They are safe and have lower repair costs.

What factors influence Toyota insurance rates?

Rates for Toyota vehicles depend on several things. This includes the model, age, and driving history. Also, your location and the coverage you choose matter.

How can I get Toyota insurance quotes?

You can get quotes by visiting insurance websites. Or, use comparison tools. You can also talk to agents who specialize in Toyota insurance.

Are there discounts available for Toyota auto insurance?

Yes, many providers offer discounts for Toyota insurance. You might get a discount for being a safe driver. Or for having safety features in your car.

How do I file a claim with Toyota auto insurance?

To file a claim, call your insurance company. Give them the accident report and any other needed documents. Then, follow their steps to handle your claim.

What are the best insurance providers for Toyota vehicles?

Allstate, State Farm, and Geico are top choices for Toyota insurance. They are known for good rates and service.

How can I find affordable Toyota insurance?

To find cheap Toyota insurance, compare quotes. Look at different coverage options. Also, use any discounts you can to lower your premiums.